Tags

| Industry |

Education Financial/Insurance |

|---|---|

| Client |

Everfi |

| Topic(s) | |

| Software |

HTML5 JavaScript SCSS YAML/JSON |

| Studio |

The Game Agency |

| Approved to Share | Yes |

Goal

Making choices about how to pay for higher education can be confusing and stressful. In the Financing Higher Education course, students will learn how to compare their education costs vs. expected return on investment, how to find free money to help pay for college, budgeting tips to help pay for college costs, and understand how to repay loans so they don’t negatively impact their future.

**Internal Note** We cannot mention Everfi as the client

Solution

This course includes six modules and covers topics like return on investment, understanding financial aid, student loan basics, budgeting for your loans, and repaying loans responsibly.

Here is the course flow:

- Course introduction – learners are introduced to one or more core characters and their narrative pertaining to the module topic

- A Pre-assessment

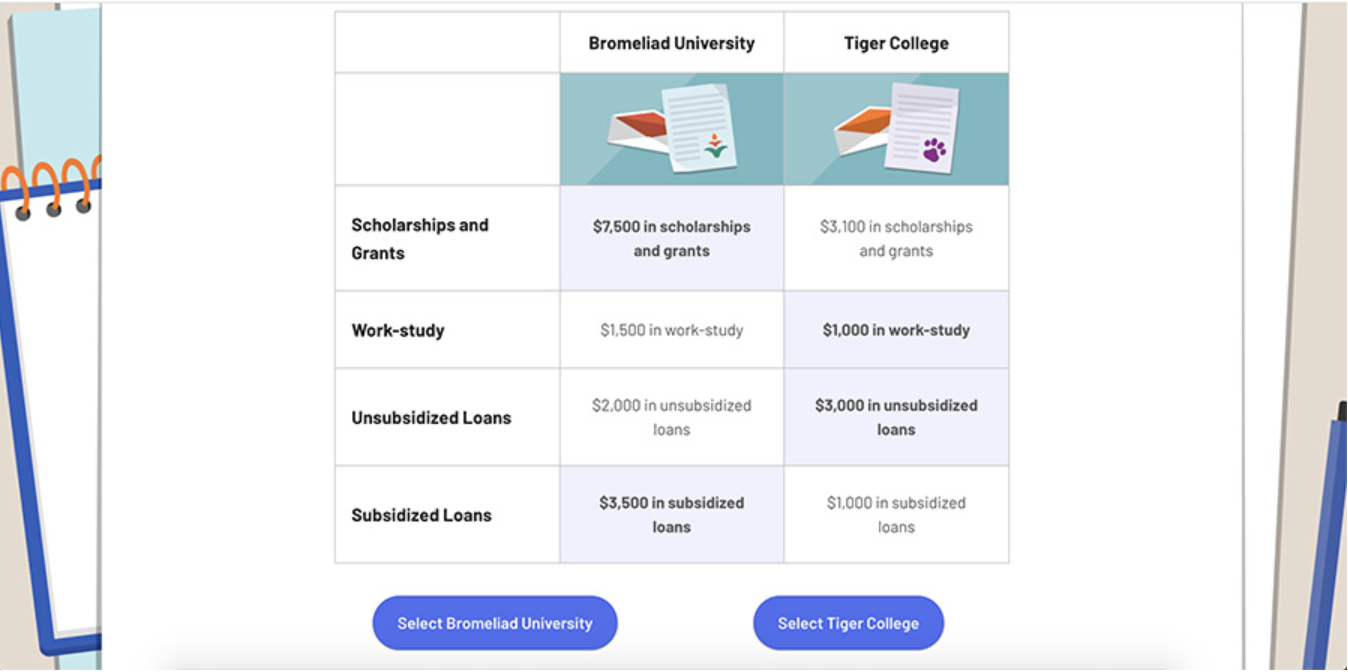

- A series of interactive pages and activities that allow learners to explore concepts related to responsible budgeting for higher education loans, how to repay them, and how to avoid common pitfalls of borrowing.

- Conclusion and Post-assessment

After taking this course, students will walk away with the confidence to become informed consumers and make wise financial decisions when choosing how to finance their higher education.

The Financing Higher Education course is based on Jump$tart National Standards in K-12 Personal Finance Education.